China has tightened its grip on the global electric vehicle (EV) supply chain by officially adding eight key EV battery technologies to its export restriction list. This latest move, announced on July 15, 2025, is already shaking up global EV markets, as companies worldwide brace for impacts on supply chains, costs, and production timelines.

This article explores what China’s new restrictions mean for manufacturers, automakers, investors, and policymakers in the U.S., Europe, and other Tier 1 markets.

📌 What’s Included in China’s New Export Rules?

According to China’s Ministry of Commerce, the following technologies will now require special export permits before being shared or sold outside China:

- LFP (Lithium Iron Phosphate) & LMFP (Lithium Manganese Iron Phosphate) cathode preparation technology

- Lithium extraction technology from spodumene, brine, and other resources

- Lithium compound refining processes, including lithium carbonate

- Non-ferrous metallurgy techniques like lithium alloys, gallium refining, and advanced cathode materials

These aren’t outright bans, but they introduce government licensing requirements, meaning any export must be individually approved (WSJ).

🌍 Why China Is Tightening EV Battery Tech Controls

China dominates the EV battery industry:

- 65% of global lithium refining happens in China

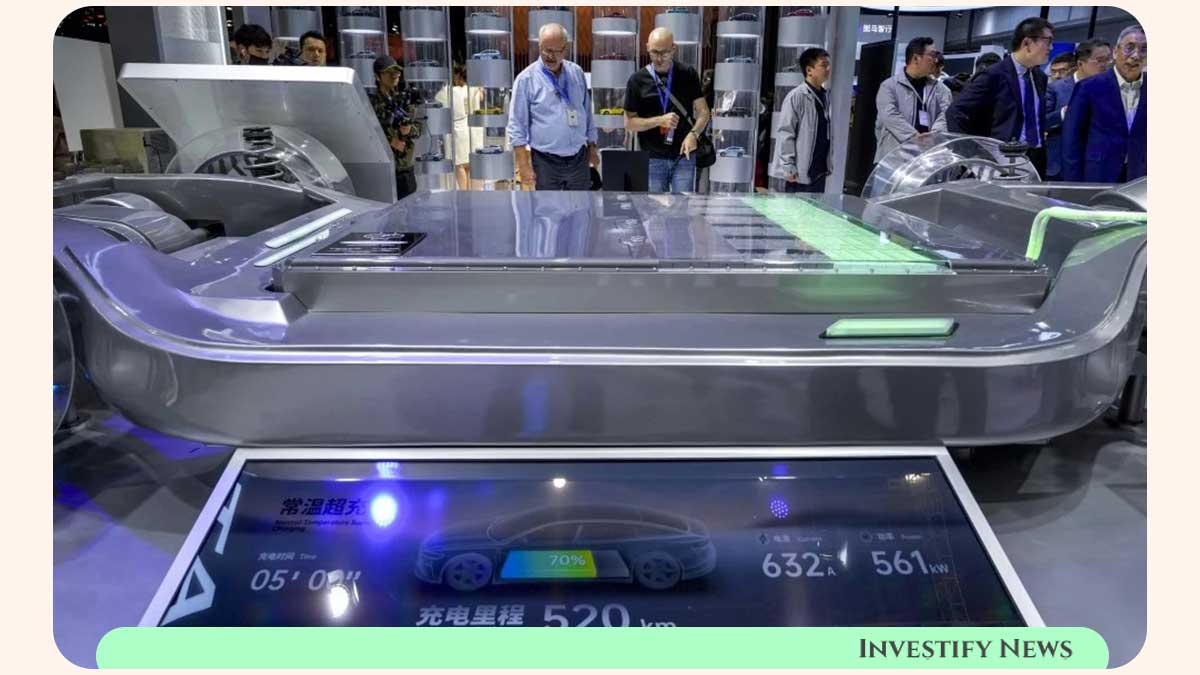

- Chinese firms like CATL and BYD control ~70% of the global EV battery market

The government aims to:

✅ Protect its intellectual property and maintain technological superiority

✅ Counter geopolitical trade tensions with the U.S. and Europe

✅ Ensure long-term control over critical raw materials and high-demand battery tech

This move follows similar actions where China restricted exports of rare earth elements and gallium used in semiconductor and defense applications (Riotimes).

🔍 Immediate Impact on Global EV Industry

🚗 Automakers at Risk:

- Ford’s LFP battery joint venture with CATL in Michigan now faces export hurdles.

- European car manufacturers sourcing battery technology from China will need special licenses.

🏭 Battery Plants Delayed:

Many North American and European battery facilities built with Chinese technology may experience approval delays, affecting timelines and potentially increasing costs.

📉 Supply Chain Rerouting:

Expect Western automakers to:

- Increase in-house battery R&D

- Expand partnerships in Australia, India, and Africa

- Accelerate U.S. Inflation Reduction Act (IRA)-backed domestic production

🔮 Long-Term Global Implications

| Effect | Short-Term | Long-Term |

|---|---|---|

| Costs | Higher prices for LFP/LMFP tech | Accelerated local innovation in U.S. & EU |

| Timelines | Delayed production starts for new EV plants | Long-term move towards battery independence |

| Politics | Trade tensions spike | Reshoring of critical supply chains |

Some analysts also predict a surge in sodium-ion batteries and non-LFP alternatives as companies try to avoid regulatory bottlenecks (DiscoveryAlert).

🧑💼 What Experts Are Saying

📢 Morgan Stanley Analysts: “A clear escalation in China’s industrial strategy — pushing Western companies to build or buy alternative supply chains.”

📢 Bloomberg Energy Analysts: “We could see battery nationalism intensify as the U.S. and EU move to decouple from Chinese tech dependence.”

📢 Independent Market Experts: “Expect price volatility in the short term, but greater regional battery supply chain growth in the long term.”

📊 How U.S. and European Governments Are Responding

- The U.S. Department of Energy may introduce additional subsidies for domestic lithium refining.

- The European Commission is fast-tracking the Critical Raw Materials Act, with incentives for local battery production.

- Trade negotiations between the U.S., EU, and Asian allies like Japan, Australia, and South Korea are likely to intensify, focusing on critical mineral access (Reuters).

🏆 Key Takeaways

- China is using its battery technology dominance as geopolitical leverage.

- Automakers must diversify supply chains and invest in non-Chinese tech solutions.

- Investors should watch for opportunities in non-Chinese lithium refiners, battery tech startups, and critical mineral mining.

- Governments are under pressure to increase domestic production capabilities and reduce dependency on China.

📝 Final Thoughts

China’s EV battery technology restrictions mark a pivotal moment in the global EV market’s evolution. For Western countries, this is a wake-up call to accelerate investment in homegrown technology and regional supply chains.

While in the short term, costs may rise and EV rollouts could slow, this policy shift is expected to catalyze innovation and industrial independence in North America, Europe, and allied nations.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.